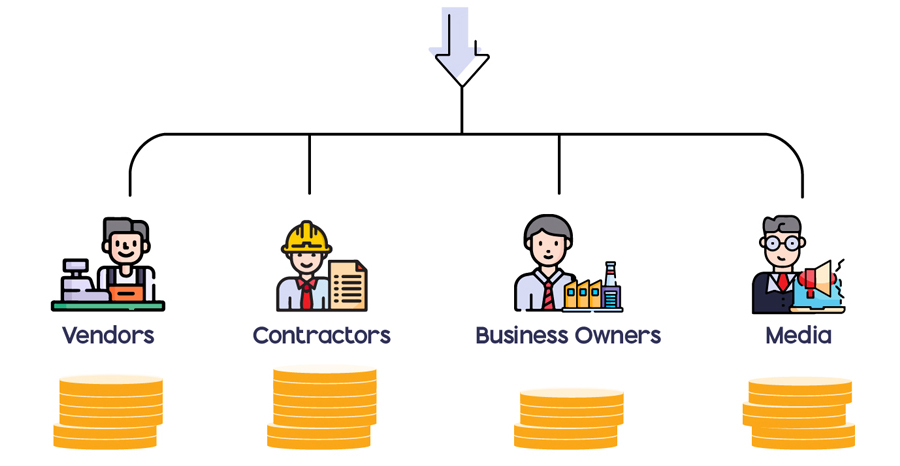

This is how your funds will earn you more with UniLyfe

India's Next Break-through Investment Product

- Annual Returns

- Risk Level

- Liquidity

- Lock-In

- Volatility

- Taxation

- Aditional fees

India's Next Break-through Investment Product

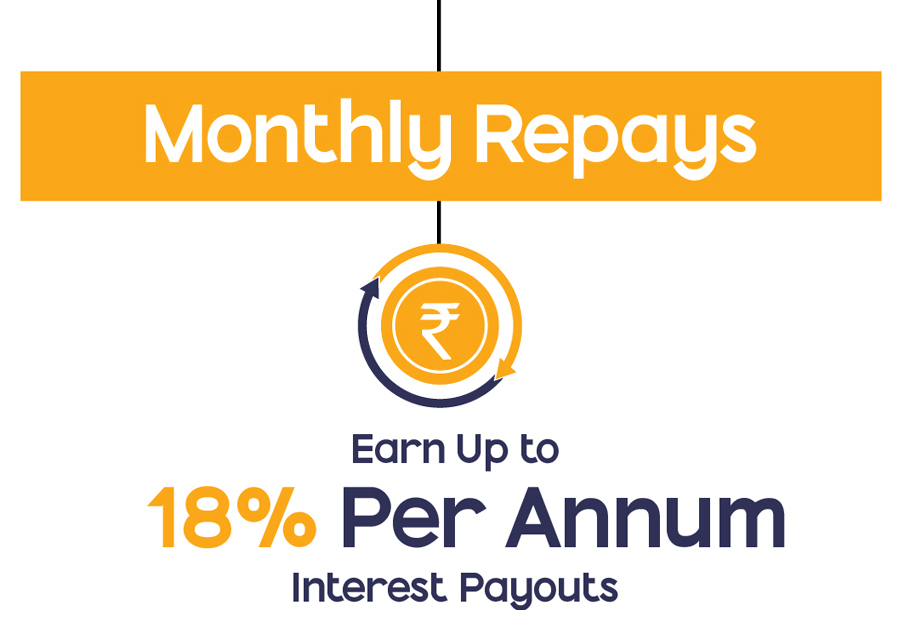

- Up to 18%

- Very Low

- High

- Minimum 3 months

- Very Low

- No TDS**

- No Fees***

- Mutual

Funds - 5 - 15%*

- Medium

- High

- Depends On Scheme

- Medium

- Capital Gains

- Several fees

- Lease/ Invoice

Financing - 5 - 15%*

- Medium

- High

- Depends On Scheme

- Medium

- TDS Deducted

- Fees Included

- Fixed

Deposits - 5 - 8%

- Very Low

- Low

- As Per Tenure

- None

- TDS Deducted

- No Fees

- Bonds

- 5 - 8%

- Very Low - Medium

- Very Low

- Depends On Scheme

- Medium

- Capital Gains

- No Fees

- ***An exit load maybe deducted if withrawl requested before lock-in

- **No TDS, income is to be declared by investor as Income from other sources.

- *Historically 5-8% for Debt-based funds and 10-15% for equity-based funds.

- Above mentioned data is sourced from reputed media publishers,

Your Investment, Your Way

Fixed-Term Investment

Take control of your financial future with our personalized fixed-term investment plans. By choosing the duration that aligns with your goals, you're not just investing money; you're strategically paving the path to financial growth. This method ensures your funds mature steadily, optimizing returns and giving you the upper hand in your financial journey. Embrace the opportunity to steer your financial destiny in a direction that resonates with your aspirations.

Calculate Returns

Meet Unilyfe: Your Partner in Financial Growth

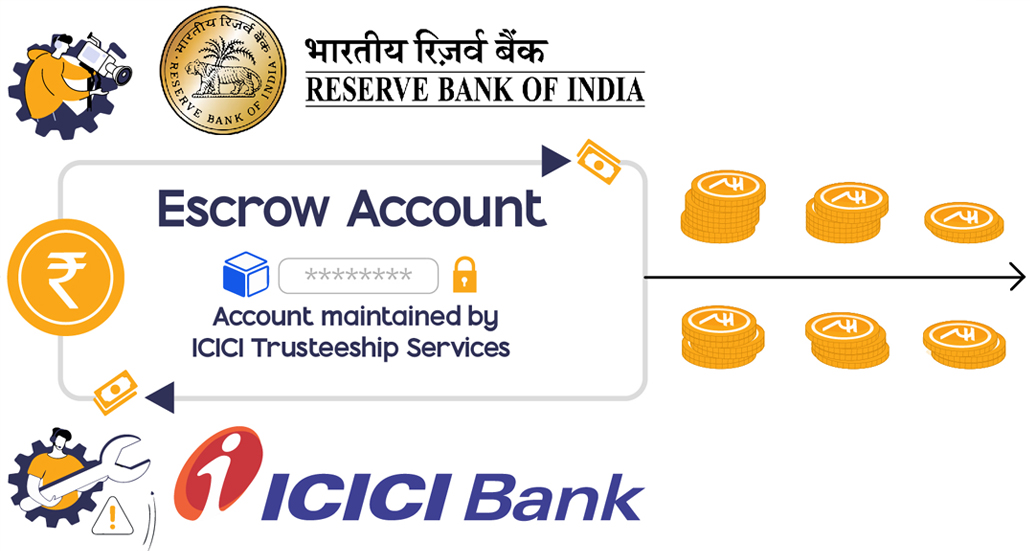

Unilyfe, we present a unique platform that proffers an enticing return on personal investment of up to 18% per annum. We empower retail consumers by offering them the opportunity to borrow at highly competitive rates. Our platform is robustly powered by Transactree Technologies Pvt Limited, an RBI-registered NBFC-P2P, fondly known as Lendbox.

Unilyfe is owned and operated by TWJ Business Consulting Private Limited, a company established under the Companies Act, 2013 (18 of 2013)

Start your investment journey in a few steps

-

01

Setup Your Account

Complete KYC process with Aadhar and PAN then link your bank account

-

02

Add Money

Add money to your investment account using UPI or Net Banking

-

03

All Set

E-sign terms & conditions & start your investment journey

Frequently

Asked

Questions

At Unilyfe, we present a unique platform that proffers an enticing return on personal investment of up to 18%. We empower retail consumers by offering them the opportunity to borrow at highly competitive rates. Our platform is robustly powered by Transactree Technologies Pvt Limited, an RBI-registered NBFC-P2P, fondly known as Lendbox. Unilyfe is a proud member of the TWJ Business Consulting Private Limited family, a company established under the Companies Act, 2013 (18 of 2013). Our headquarters charmingly nestles in Unit – 1100 to 1110, Zion Apartment, Sector 10, Kharghar, Navi Mumbai, Maharashtra 410210.

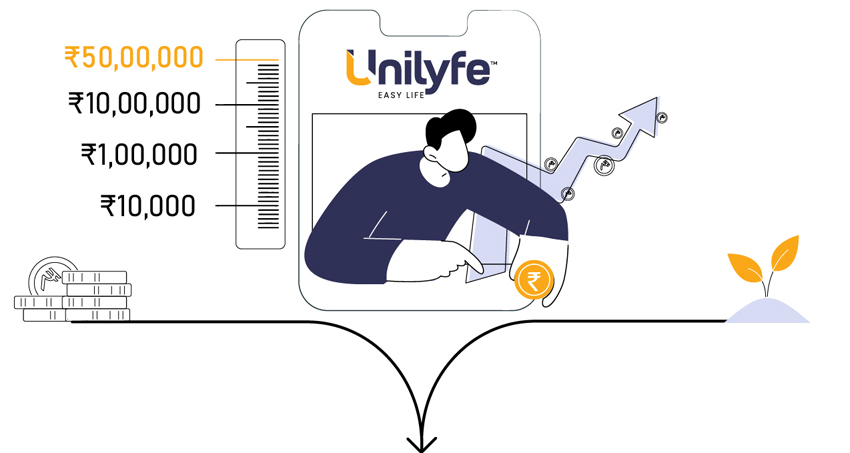

- The investment period commences for a minimum of 3 months.

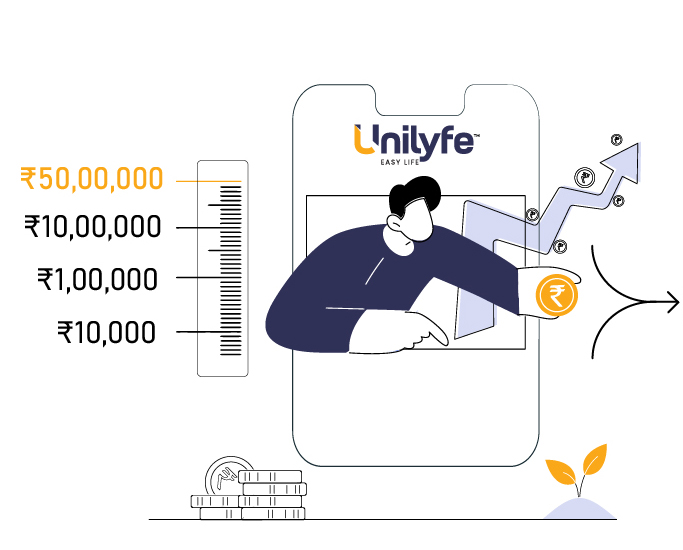

- Investment amounts can range from a minimum of 10 thousand ruppes up to a maximum of 50 lakhs.

- For investments exceeding 10 lakhs, a Networth Certificate must be presented.

- Withdrawals are TDS-free, ensuring you get the whole amount.

- Enjoy zero investment fees on all the investments.

- Ameture withdrawals may incur an exit load, as determined by the UniLyfe management team

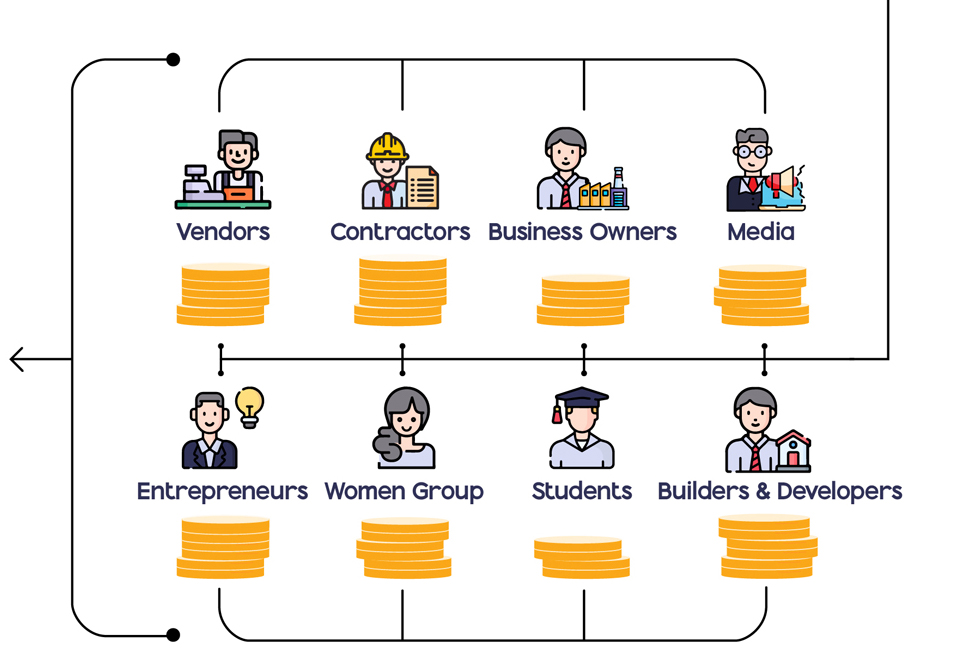

Unilyfe is not just any service provider, but a web-based peer-to-peer platform specializing in unsecured retail loan products. The returns on your investment and the security of your principal amount are contingent on the borrowers' loan repayments. However, Unilyfe's unique advantage lies in its carefully curated and limited user pool, which enhances recovery prospects. Additionally, our sophisticated allocation algorithms ensure credit risk mitigation by promoting diversity.

We place the highest priority on safeguarding your personal and financial data. As such, we utilize strong encryption and other cutting-edge security protocols. For a more detailed understanding, we encourage you to review our privacy policy. Our data collection and usage partners operate under the stringent regulations of the RBI.

MITC (Most Important Terms and Conditions) agreement is a comprehensive document designed to detail the key terms and conditions associated with a specific product or service. For financial institutions, the MITC offers a thorough insight into relevant fees, interest rates, payment due dates, the length of the interest-free period, and other crucial details.

Need more assistance?

Talk to our experts